eliminate

My Income Tax

A done for you blueprint with results in 90 days!

Thompson Bourque

Business owners unlock the key to eliminate their income taxes

Federal and state income taxes often eat up 35-50% of our client’s annual income and most of them have never received proactive tax planning from their CPA.

We review dozens of business returns each year from our prospective clients and over 80% of them have errors or missed tax savings opportunities.

If you are ready to eliminate your tax liability & increase your cash flow book your *Free Tax Savings Assessment* now to see how much you can eliminate!

We strategize and implement processes that eliminate your tax liability on-going so that you never have to wonder what your tax bill is going to look like again.

Industries We Specalize In

Real Estate Short Term & Long Term Rentals

Service Based 1099 Contractors & Consultants

Digital Creators & Influencers

Business & Mindset Coaches

Do you feel like your taxes are too complicated to handle by yourself?

Do you feel like your taxes are too time-consuming and take you away from other priorities?

Are you unsure about all of the deductions, credits, and strategies your business can use to pay less?

Is it hard for you to manage the cash flow for your quarterly tax payments?

Do you hardly hear from your CPA/preparer and find it hard to get questions answered?

Have you had a surprise tax bill or notice from the IRS that made you feel stressed?

Have you had a surprise tax bill or notice from the IRS that made you feel stressed?

The Strategy Your Business Needs!

eliminate

My Income Tax in 90 Days

Tax Calculator & Assessment:

Meet with us to see how much tax you are on track to owe this year and identify ways to eliminate your tax bill.

Tax Plan

Blueprint:

Your personalized tax strategies and insights into what they are, how they work and the impact they have.

Done for you Implementation:

Our team will guide you through the implementation steps for each strategy to maintain the process and compliance.

Upkeep:

Business & life change. We proactively strategize tax impacts to take advantage of the Tax Code and eliminate your tax

1-1 Tax plan Assessment PDF that shows estimated liability

Tax Plan Blueprint with exact strategies and estimated savings

Strategies Video Series for insights any time

90 Day Done For You Implementation

PDF New Business Kit with LLC, Agreement, EIN

Official Business Binder with everything you need for the bank.

Done For You Payroll Set Up & Salary Calculator

Educational Materials Including Sheets, Trackers, Videos & Trainings

Standard Operating Procedures for maintaining compliance processes and eligibility for savings.

Client Portal so you never have to shuffle paper for your important files again.

Automated reminders for important deadlines to eliminate late fees, penalties and interest

Get implementation questions answered in chat everyday

(3) 1-1 60 Minute Monthly Strategy Sessions

Bonus: Calculate Your ROI cash savings

Use this 20 minute 1:1 to review your most recent tax return, estimate your current taxliability and identify potential savings.

Month 1

Tax Calculator & Assessment

Onboarding & Goal Setting

60 Minute 1-1 Strategy Meetings

Tax Plan Blueprint Delivered

Phase 1 Implementation Blueprint

Month 2

60 Minute 1-1 Strategy Meetings

Phase 1 Implementation

Phase 2 Implementation Building

Track Savings

Month 3

Phase 2 Implementation

60 Minute 1-1 Strategy Meetings

Phase 3 Implementation Ongoing

Calculate ROI & cash redirected

Q: What is the difference between tax prep & tax strategy?

A: Tax Prep = 1 Time Per Yr

Tax Strategy = Ongoing

Q: What if I already have a CPA/Preparer?

A: Great, we can help you identify strategies before you meet with your CPA

2024 Tax Liability calculator

2020 YE Est

2021 YE Est

Real Stories with Real Results

Online Business Coach

Background: 1099-Misc Income earnings into six figures annually

Challenges: “Challenges that prompted me to seek your services were optimizing deductions, dealing with previous tax issues, lack of time for proper tax planning”

Solutions: Custom tax planning specific to her business along with implementation for the current and future years. Consistent review and planning to maintain savings year over year.

Add a Call-to-Action

Without proper strategy

2022 YE Est

Wages, Tips & Salaries

Other Income

Business Income

Business Loss

Adjusted Gross Income

Standard Deduction

QBI Deduction

Adjustments to Income

Estimated Deductions & Credits

Taxable Income

Total Federal Tax

Total State Tax

Child Tax Credit

SE Tax

Total Tax

Tax Bracket %

0

206514

0

0

$206,514.00

18650

0

11303

0

$176,561.00

37515

9863

2000

22606

$67,983.88

32%

0

0

159596

0

$159,596.00

18800

0

10675

0

$130,121.50

23798

6831

2000

21349

$49,978.54

24%

0

0

146456

0

$146,456.00

19400

0

10499

0

$116,557.44

20612

6119

2000

20997

$47,727.92

24%

3 Year Before Total Tax = $165,690

Est. Penalties Fees & Interest = $21,780

VS

With proper strategy

2024 YE Est

2021 YE Est

2022 YE Est

Wages, Tips & Salaries

Other Income

Business Income

Business Loss

Adjusted Gross Income

Standard Deduction

QBI Deduction

Adjustments to Income

Estimated Deductions & Credits

Taxable Income

Total Federal Tax

Total State Tax

Other /Child Tax Credit

SE Tax

Total Tax

Total Witholdings

Total Overpayment W/out Planning

Tax Bracket %

0

176052

0

0

$176,052.00

18650

35210

10895

0

$111,296.60

20791

8264

7110

21790

$43,734.29

0

$24,249.59

24%

0

0

111864

0

$111,864.00

18800

14613

0

47732

$78,451.00

11397

4886

2000

0

$14,283.10

0

$35,695.44

24%

44510

0

70077

0

$114,587.00

19400

14015

0

76379

$81,171.60

11975

4262

2000

0

$14,236.26

0

$33,491.66

22%

For Illustrative purposes only, these are not exact numbers. Everyone's specific tax situation is different, these do not demonstrate guaranteed savings. Savings can be reach through planning and proper implementation.

Without tax planning client would have paid over 6 figures in taxes over just 3 years!

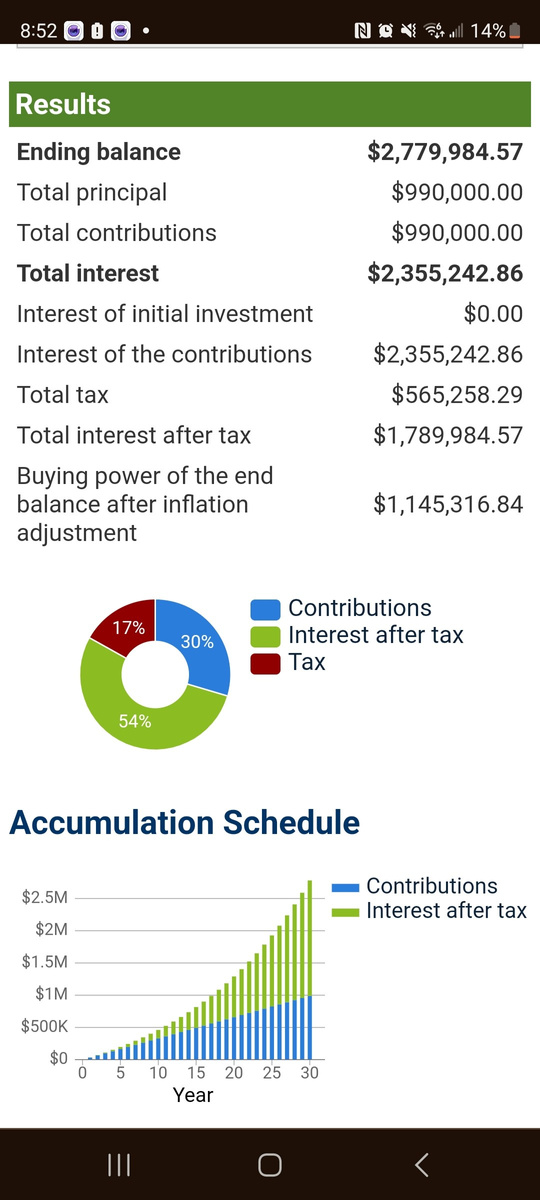

3 Year ROI = 861%

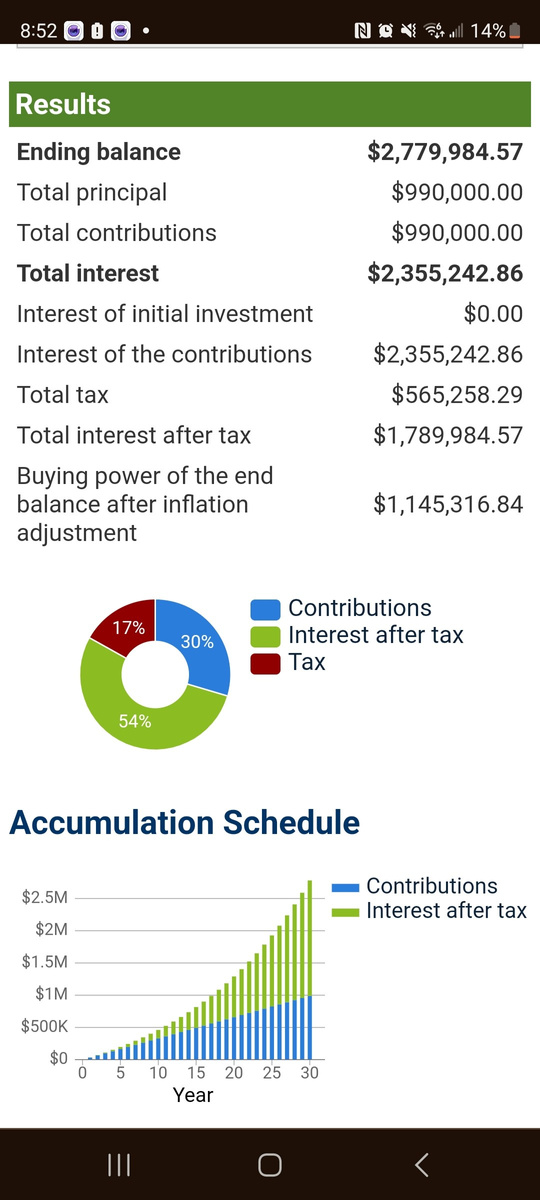

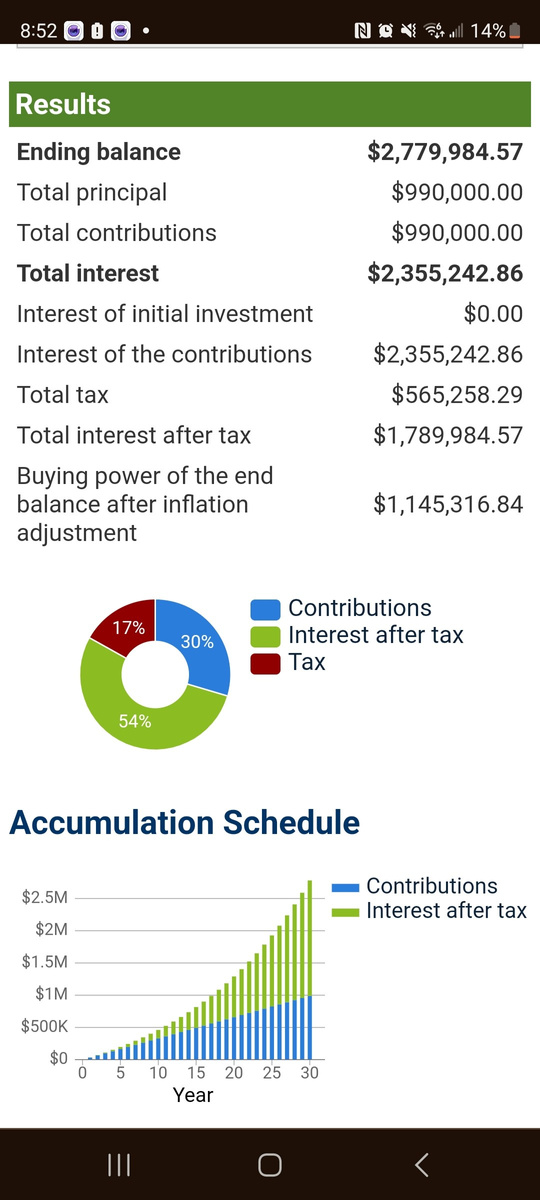

Reinvest in Your Business

3 Year New Total Tax = $72,253.39

3 Year Total Savings = $93,436.61

Est. 10 Year Total Savings = $311,453

Est. Lifetime Savings = $1,557,265

Expansion

Inventory

Assets

Employees

Marketing

Education

Retirement

Upgrades

Benefits

Impact of Reinvesting Savings

Our favorite clients

I am extremely satisfied with the services I received. Thompson is knowledgeable, professional, and consistently goes above and beyond to ensure my financial needs are met without judgment. Thompson expertise in tax planning and accounting has saved me both time and money.

T. Wilson

Thompson is very attentive and thorough and explains everything in depth so you have a full understanding of what is happening with your business

S. Thompson

You’d be in trusted and experienced hands with Crucial Business Solutions and Thompson Bourque handling your business needs.

J. Sosna

Meet Your Experts

With over 45 years of combined experience, we specialize in helping business owners and real estate investors manage their accounting, tax planning, preparation, and audit needs. Our team is committed to delivering personalized, strategic guidance to help you reduce tax liabilities and maximize financial growth.

Galit brings over 15 years of expertise in accounting for small businesses and real estate, helping clients achieve financial clarity and success.

As the founder of Tsadik G. Management and a Certified Financial Education Instructor, she is dedicated to empowering entrepreneurs to take control of their financial destinies.

Her 'S-H-A-R-K' money wisdom is a game-changer, guiding clients to face their financial challenges head-on and uncover powerful opportunities for growth.

By partnering with Galit, our clients don’t just save time and money—they gain the confidence and strategy to break free from financial stress and live out their dreams.

Zhanna is a NYS CPA with over 16 years of experience in tax preparation, including personal, corporate, partnerships, and trust returns.

With certifications as a Certified Internal Auditor and Certified Fraud Examiner, Zhanna’s diverse expertise helps clients navigate complex financial and tax scenarios with precision.

Beyond tax services, Zhanna forms corporations and LLCs across the U.S. and is a licensed real estate broker.

As a property manager and landlord, she understands the financial challenges of real estate, making her an invaluable asset for business owners and investors looking to maximize returns while staying compliant.

Thompson has 14 years of experience in small business accounting and tax. I founded Crucial Business & Life Solutions to help entrepreneurs take control of their finances and achieve their business goals.

Specializing in tax deduction maximization, business structure optimization, and cash flow management through KPIs, I assist self-employed individuals transitioning to full business ownership.

My mission is to help you uncover and reach your unique definition of success, transforming your business and your life in the process.

Witnessing the positive impact on our clients and their families drives me every day.

Galit Tsadik

The FINancial Sharktress

Zhanna Kelley CPA, CIA, CFE

Thompson Bourque

Accountant & Tax Strategist

Greater stories & greater results

Solo-Preneuer

W2 Employee w/ 1099 & Rental Income

Couple with W2 Income &

Sch C Consulting Services Income with a 6 Unit Long Term Rentals

Small Business Owner & Real Estate Investor

Owner of a Small Real Estate business with activities Sales, Short Term & Long Term Rentals, Fix N Flips, & New Builds.

Before

After

Before

After

2020

Taxable Income

Total Federal Tax

Total State Tax

Other Credits

Child Tax Credit

SE Tax

Total Tax

Total Savings

2021

Taxable Income

Total Federal Tax

Total State Tax

Child Tax Credit

SE Tax

Total Tax

Total Savings

2022

Taxable Income

Total Federal Tax

Total State Tax

Child Tax Credit

SE Tax

Total Tax

Total Savings

2023

Taxable Income

Total Federal Tax

Total State Tax

Child Tax Credit

SE Tax

Total Tax

Total Savings

2020

Taxable Income

Total Federal Tax

Total State Tax

Other Credits

Child Tax Credit

SE Tax

Total Tax

Total Savings

2021

Taxable Income

Total Federal Tax

Total State Tax

Child Tax Credit

SE Tax

Total Tax

Total Savings

2022

Taxable Income

Total Federal Tax

Total State Tax

Child Tax Credit

SE Tax

Total Tax

Total Savings

2023

Taxable Income

Total Federal Tax

Total State Tax

Child Tax Credit

SE Tax

Total Tax

Total Savings

2020

Taxable Income

Total Federal Tax

Total State Tax

Other Credits

Child Tax Credit

SE Tax

Total Tax

2021

Taxable Income

Total Federal Tax

Total State Tax

Child Tax Credit

SE Tax

Total Tax

2022

Taxable Income

Total Federal Tax

Total State Tax

Child Tax Credit

SE Tax

Total Tax

2023

Taxable Income

Total Federal Tax

Total State Tax

Child Tax Credit

SE Tax

Total Tax

2020

Taxable Income

Total Federal Tax

Total State Tax

Other Credits

Child Tax Credit

SE Tax

Total Tax

2021

Taxable Income

Total Federal Tax

Total State Tax

Child Tax Credit

SE Tax

Total Tax

2022

Taxable Income

Total Federal Tax

Total State Tax

Child Tax Credit

SE Tax

Total Tax

2023

Taxable Income

Total Federal Tax

Total State Tax

Child Tax Credit

SE Tax

Total Tax

$88,841.60

11474

2630

10274

4000

0

$0.00

$17,253.54

$192,650.70

34395

10114

5110

4000

23857

$59,256.33

$90,391.81

$443,518.50

103957

23034

0

1200

23857

$149,648.14

$107,058.00

15133

3321

0

1200

0

$17,253.54

$200,910.80

36261

9419

3000

0

$42,679.66

$54,048.66.

$43,357.20

5071

2558

4950

1582

$4,261.00

$11,759.22

$293,717.00

56115

15226

0

25388

$96,728.32

$89,001.00

11077

3327

1200

2816

$16,020.22

$322,208.00

65001

16916

4000

0

$77,916.84

$186,135.79

$80,581.50

7878

1259

4003

4317

$5,134.00

$30,149.04

$756,953.50

214622

23920

0

25511

$264,052.63

$157,917.50

25976

4990

1125

4317

$35,283.04

$213,227.00

37974

11194

4000

0

$45,168.90

$260,952.09

$60,129.00

3775

0

3775

0

$0.00

$31,133.42

$161,043.00

26044

5089

2000

0

$31,133.42

Total Client Savings to Date

$90,295.23

Numbers are for illustrative purposes only.

$833,219.50

238205

42405

0

25511

$306,120.99

Total Client Savings to Date

$591,528.35

Numbers are for illustrative purposes only.

Total Client Savings $3,259,000+